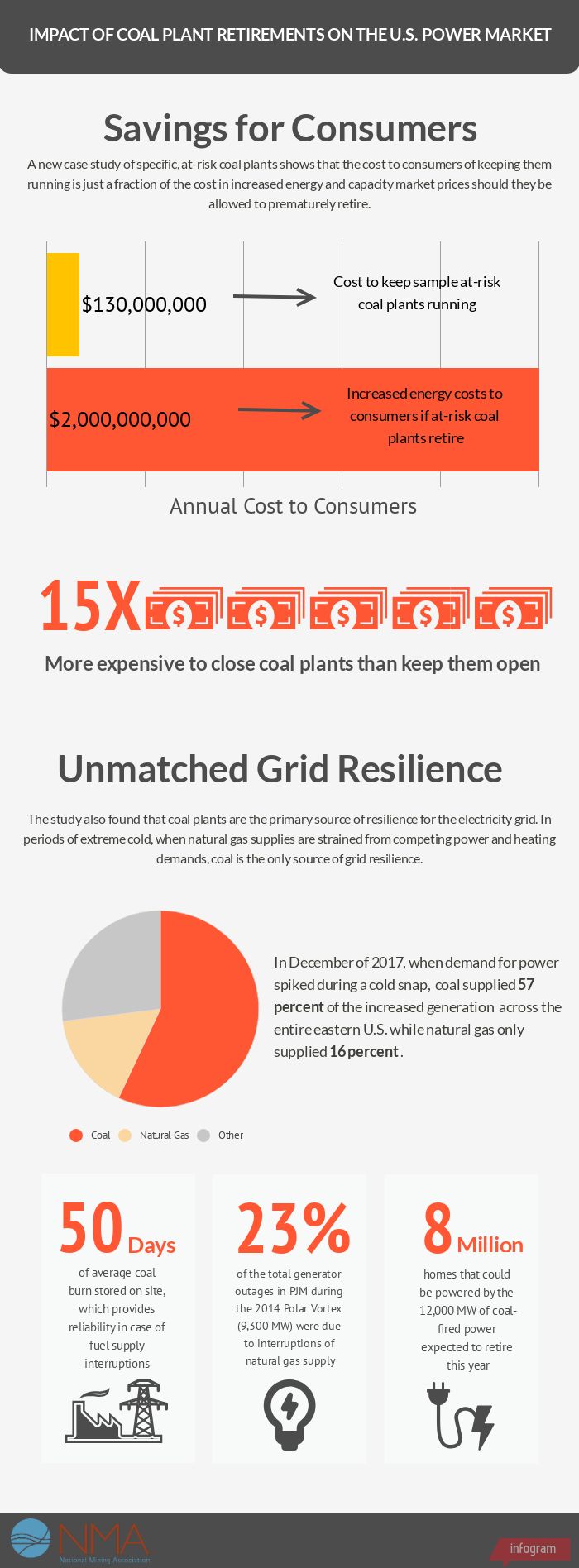

Case Study of At-Risk Plants Finds Cost to Consumers of Premature Coal Plant Retirements is 15 Times More Than The Cost of Supporting Continued Plant Operations

WASHINGTON, D.C. – The cost to consumers of premature retirements of coal vastly outweighs the cost of supporting continued operations, according to a study conducted by Energy Ventures Analysis (EVA) for the National Mining Association (NMA), commissioned to assess the impact of coal plant closures on the U.S. power markets. The study also found that, during periods of extreme cold weather when natural gas supplies are strained from competing power and heating demands, coal is the only source of resilience for the grid.

View the report here.

“This report confirms through specific analysis of actual at-risk plants that the cost of doing nothing far exceeds the costs of policy measures to support existing coal plants providing reliable and resilient generation for the power grid,” said Hal Quinn, NMA president and CEO. “If we are going to deliver on the promise of affordable, reliable energy for all Americans, action must be taken to support at-risk plants and safeguard the diversity of our grid.”

“We found that, despite the fact that the markets are not structured to value coal plants for the reliability and resilience that they provide to the market, coal plants are the primary source of resilience for the power market,” said Seth Schwartz, EVA President. “Wind, solar and nuclear plants typically operate at maximum generation when they can, and natural gas needs to meet both power and heating demands during peak cold periods. As more coal powered generation retires, the cost to consumers is significantly more than maintaining the current, diversified mix.”

Specific findings of the report include:

- Increased costs to consumers in the PJM market to shut down sample at risk coal plants due to increased energy and capacity market prices: $2.0 billion annually.

- Cost to keep at risk plants running: $130 million annually.

- Capital cost to replace coal plants with the same amount of Combined Cycle Gas Turbines (CCGT) capacity: $5.7 billion.

- Across PJM, 23 percent of the total generator outages during the 2014 Polar Vortex were due to interruptions of natural gas supply.

- On the peak day of winter demand January 7, 2018, almost half of the PJM natural gas capacity could not supply power from natural gas, with 30 percent offline and 20 percent burning oil instead of gas.

###